Amortization Schedule Calculator

Amortization Pro: The Ultimate Loan Analysis & Debt Repayment Suite

Navigating the complexities of long-term debt requires more than just a simple payment estimate. Amortization Pro is a professional-grade financial engine designed to provide institutional-level clarity on your mortgage, auto, or personal loans. By breaking down every cent of your repayment journey, this tool empowers you to make smarter financial decisions.

📖 The Ultimate User Guide: How to Master Your Loan Strategy

Managing your debt with Amortization Pro is a strategic process. Follow this professional roadmap to visualize your path to financial freedom:

1. Essential Data Input

To generate your customized repayment schedule, input the following core variables:

- Loan Amount ($): The total principal balance you intend to borrow or currently owe.

- Interest Rate (%): The annual percentage rate (APR) assigned to your loan.

- Loan Term (Years): The total duration of the loan agreement.

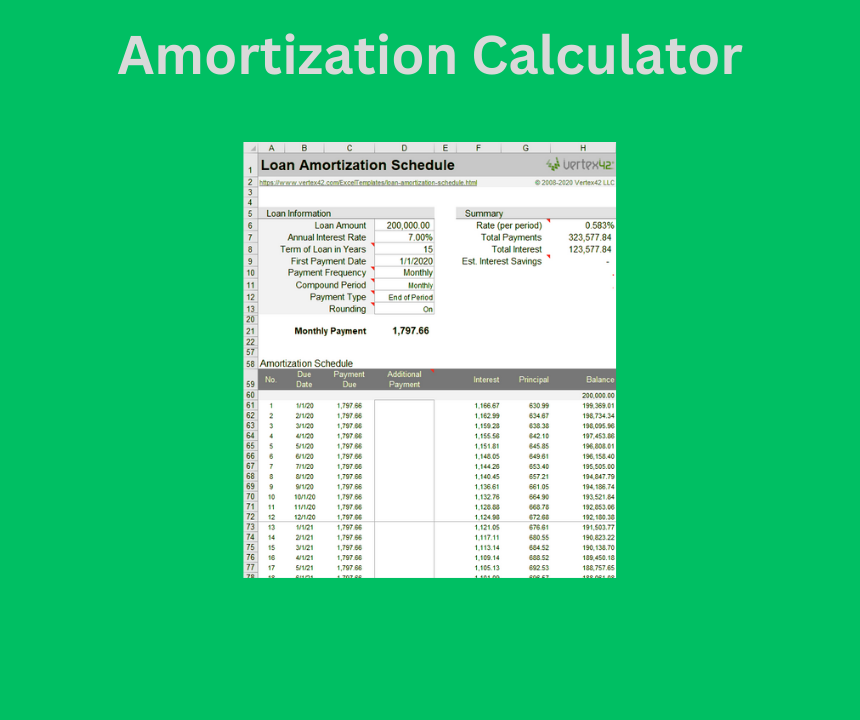

2. Analyzing the Amortization Schedule

Once you click “Calculate,” our engine generates a high-definition (HD) table that dissects every monthly payment:

- Principal Component: The portion of your payment that directly reduces your debt.

- Interest Component: The cost of borrowing paid to the lender.

- Remaining Balance: A real-time look at your outstanding debt after each installment.

3. Fixed Principal vs. Fixed Payment

While most standard loans use fixed monthly payments (where interest decreases and principal increases), our tool allows you to understand how your debt behaves under different structures. This insight is crucial for those looking to pay off loans early through extra principal contributions.

❓ Frequently Asked Questions (FAQs)

Q1: What exactly is “Amortization”? Amortization is the process of spreading out a loan into a series of fixed payments over time. Each payment is divided into interest and principal until the balance reaches zero at the end of the term.

Q2: How does a higher interest rate affect my schedule? A higher rate significantly increases the “Interest Component” in the early years of the loan. This means less of your money goes toward the principal, extending the time it takes to build equity.

Q3: Can I use this for my mortgage and car loan? Absolutely. Amortization Pro is a versatile suite designed for any installment-based debt, including mortgages, auto loans, student loans, and personal bank loans.

Q4: Does the tool account for escrow or insurance? This calculator focuses on the Principal and Interest (P&I). Taxes, insurance, and HOA fees (escrow) are typically added by your lender on top of these results.

Q5: Is it better to pay more principal early? Yes. Increasing your principal payments early in the schedule reduces the total interest you will pay over the life of the loan, potentially saving you thousands of dollars and years of debt.

🎓 Meet the Expert: Financial Verification

Verified by Marcus Sterling, CFA

Senior Financial Analyst & Investment Strategist

Marcus Sterling is a seasoned financial consultant with over 12 years of experience in capital markets and personal finance management. Holding the Chartered Financial Analyst (CFA) designation, Marcus specializes in algorithmic financial modeling and debt restructuring.

The Amortization Pro engine has been rigorously tested and verified by Marcus to ensure that all underlying formulas—including the Time Value of Money (TVM) and Declining Balance algorithms—align with 2026 global banking standards. His verification ensures that users receive the same precision used by institutional lenders.

⚖️ Professional Financial Disclaimer

Important Notice: The results provided by Amortization Pro are for educational and illustrative purposes only. While we strive for surgical precision, these calculations are estimates and do not constitute professional financial, tax, or legal advice. Market conditions and specific lender policies may vary. We recommend consulting with a Certified Financial Planner (CFP) before making significant financial commitments.